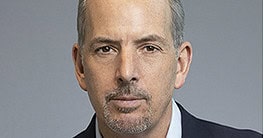

Javier Rodríguez Soler, global head of Sustainability and Corporate & Investment Banking (CIB) at BBVA, speaks to Global Finance about the bank’s strong year and how it is maintaining momentum.

Global Finance: How did BBVA’s corporate banking business achieve such a strong year?

Javier Rodríguez Soler: Indeed, BBVA Corporate & Investment Banking had a great 2023, with annual revenue of €4.8 billion [$5.3 billion], and just in the first half of 2024, we generated revenue of €2,872 million, up by 23% on 2023. We devise our strategy based on globality—with a focus on geographical diversification, the opportunities derived from nearshoring and the increased relevance of business with institutional clients—and sustainability, which is a strategic priority at BBVA in all its business lines.

Combining growth and sustainability is one of our mantras. I am a true believer that it is possible to grow and decarbonize at the same time, and BBVA is a living proof of this.

In a business environment that demands the transition to more sustainable production models and adherence to global regulatory requirements that set the standard in terms of ESG, sustainability emerges as a key element to face a volatile world influenced by global events. That’s why we have implemented a sector-related advisory model to proactively address transition opportunities. It’s a model that reaches the whole organization—all our geographies, all our bankers and all our business products.

GF: Where do you see growth in the coming year?

Soler: For us, growth will come mainly through three levers: our advisory services, the big bets we have been working on over the past few years, and our investments in equity funds.

In terms of advisory, we have two relevant lines of work. First, we have sector strategies for corporate clients and plans in the most emission-intensive sectors to define a commercial strategy with our clients to finance the transformation to low-carbon technologies and to accompany them in their transition plans. We also offer advisory on specific solutions and cost-cutting issues such as energy efficiency for business clients, leveraging specialized teams that develop data-driven solutions and tools.

Second, we keep working on plans and specific initiatives to strengthen our long-term competitive position with existing businesses by leveraging our digital capabilities and advisory; leveraging sustainability capabilities to grow in new markets with a niche strategy; and developing new business to respond to sustainable transformation needs.

Last but not least, our investment in top-tier capital climate funds is critical to our success in this journey. We have already invested more than €100 million in cleantech projects through six fund managers, who in turn have invested in over 160 companies.

GF: How do you expect corporate banking will change in the next few years?

Soler: One of the main changes will come from data and artificial intelligence, and its environmental impact should be a concern. Large language models are indeed very power-hungry. That is why we are looking into a new generation of models that achieve comparable performance with fewer parameters, significantly reducing energy consumption.

One of our primary strategies at BBVA is adhering to the principle of data minimization when building AI models. By using the data that is absolutely necessary, we create smaller, more efficient models that require less computational power—and consequently, less energy.

GF: Are there any business issues that keep you up at night?

Soler: What I see is that supervisors in different industries, and in particular the banking industry, as well as the politicians in the different geographies where we operate may not be moving at the same pace as we are at BBVA in terms of understanding the relevance of sustainability and decarbonization and where the world is heading with the development of new technologies.

The role of governments in creating an enabling environment for decarbonization is crucial. In my opinion, a new industrial policy is key. It also needs to ensure relevant and adequate incentive schemes and facilitate faster permits with less bureaucracy, as some countries such as the Netherlands and Denmark have already done with a one-stop shop for relevant investment projects.